Financial freedom is something most of us desire to achieve. Having more money can give us a better life – we get to buy and enjoy the things that we want, participate in the experiences we desire, and we can use money to solve our problems.

How do we earn more money and grow our wealth?

How should our attitude with money be likw?

What financial habits should we develop to achieve our financial goals?

Why We Should Set Financial Resolutions

By setting financial resolutions, we have clear objectives regarding what we want or need to do to achieve our financial goals, such as saving for emergencies, investing for the long term, or debt reduction. This encourages us to create a structured approach to managing money via the allocation of resources across different areas according to our goals and aspirations.

Additionally, having financial resolutions facilitates a mindset shift from short-term gratification to long-term planning, promoting financial discipline through responsible money habits.

The means to achieve financial freedom lie in the consistent pursuit of your financial resolutions, and to keep you going through that journey, it is ideal to monitor your progress across time, adapt and amend strategies when necessary, and stay focused on the ultimate goal of financial independence.

Financial Freedom Resolution 1) Save Money Every Month

Saving money is like giving your future self a high-five! It requires discipline, and forgoing instant gratification.

Let’s be real – we’ve all been there, caught in the temptation of a spontaneous purchase or a not-so-budget-friendly weekend.

But making a financial resolution to save money is like setting up your own personal safety net. It’s not about depriving yourself of that occasional treat; it’s about being intentional with your spending. So, instead of ordering that third cup of fancy coffee this week, consider brewing your own and watching your savings grow. Small changes, like packing your lunch or resisting the urge to online shop for things you don’t really need, can add up.

It’s not about becoming a financial wizard overnight; it’s about making those little money-saving choices that add up to big wins for your bank account and your future plans. Think of it as a self-care routine for your wallet – because a healthy financial future is something worth investing in!

So start by saving a portion of your monthly income – you can follow the 50-30-20 rule or amend the savings % according to your own capacity or goal.

To learn more about saving and budgeting to plan for your retirement, read the introductory article on personal finance, and check out My Rich Future’s Budgeting & Financial Planning toolkit.

Financial Freedom Resolution 2) Invest to Grow Your Wealth

“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffett

Now that you have started to save money every month, let’s talk about transforming those hard-earned bucks into financial freedom superheroes that work tirelessly for you, even while you’re catching some ZZZs.

Making investing a financial resolution is like sowing the seeds for a future money garden – where you water it now, and later, you reap the benefits of a bountiful harvest. It takes time, but you will enjoy the fruits of your labour – and in this case, you don’t even have to work too hard because the financial markets will work for you!

If you do not have much knowledge about financial markets, it is never too late to learn! There are so many things that you can invest in – stocks, money market funds, real estate, gold, cryptocurrencies and also alternative assets. In The Financial Fuse, you can learn more about investing as well as business, so read through the articles in this website and sign up for the newsletter to get the latest updates!

Read more about Investing in Retirement Funds in Malaysia.

Read more about Real Estate.

Read more about Stocks.

Read more about Cryptocurrencies.

Property investment example:

Let’s say you buy a property worth RM500,000 and you rent it out for RM1,800 every month – this will give you 4.3% annual returns passively.

If you have several rental properties, your total rental income can be quite substantial, which allows you to earn money just by being a landlord.

If you rent out your property as AirB&B whereby you charge a nightly rate, your income potential and thus annual returns will likely be higher than if you just rent it out to a single tenant.

Stocks investment example:

The average annual historical return of US S&P500 stocks is about 10%.

If you invest just $500 every month in the US stock market for the next 20 years, you will have $343,650.

If you invest $1000 every month in the US stock market for the next 20 years, you will have $687,300.

As such, for a particular rate of return, the more money you invest, the faster you will grow your wealth.

Another factor that affects your wealth is the annual rate of return of your investments.

If you invest in growth stocks such as technology stocks, the returns are even greater.

For example, Alphabet stock (Google) has grown by 157% over just 5 years from 18 Jan 2019 to 18 Jan 2024.

Averaging this out across 5 years would mean about 30% annual average rate of return!

Additionally, there are stocks that can potentially return more money than Google if you manage to pick the right stocks at the right time! (check out the How to Invest in Megatrends Ebook)

Picture the act of investing as giving your money a purpose – to grow, multiply, and ultimately help you achieve that sweet financial freedom you’ve been daydreaming about.

If you are new to investing, you can start with a modest amount in lower risk assets such as in retirement funds or schemes, money market funds, real estate with good rental yields, and high quality stocks that have stood the test of time.

As you learn more and are willing to take higher risks and higher returns, you can invest in growth stocks and cryptocurrencies – these have the potential to double or triple your money, or even more! In fact, 10x and 20x returns are possible with cryptocurrencies.

However, the risks involved are high (aligning with the potentially higher returns) and they may not be ideal for everyone. Nonetheless, the more you learn and put your knowledge into practice, the more you are able to generate higher potential returns.

Investing doesn’t have to be daunting; it’s about taking a step, any step, towards securing your financial future.

Don’t just leave all your spare cash in your wallet or in your savings account, when it could be deposited elsewhere to work towards your financial freedom!

Financial Freedom Resolution 3) Be patient. Practice Discipline & Emotional Control.

Patience is one of the most valuable attributes an investor can possess, especially when considering the US stock market and cryptocurrency market’s history of cyclical ups and downs.

While market crashes can be nerve-wracking, panicking and selling often leads to missed opportunities for long-term wealth accumulation. Here are some reasons why you should be patient during market downturns:

The US stock market has endured numerous crashes throughout its history, from the Great Depression to the 2008 financial crisis.

However, after each dip, it has ultimately recovered and reached new highs.

For example, during the 2008 crash, the US S&P 500 index lost over 50% of its value. Within five years, it had doubled from its crash lows and returned to its pre-crash level. This pattern of recovery demonstrates the resilient nature of the US market over the long term.

Since then, from 2009 until the end of 2023, the US stock market has been growing at an average rate of around 12% per annum. Not bad for a buy-and-hold passive investment without having to pick stocks.

Market swings are often driven by short-term emotions and economic noise. However, the underlying fundamentals of strong companies typically remain intact.

During a market crash, focus on the long-term potential of the companies you’ve invested in. If their business models are solid, financial performance has been strong pre-crisis, and their future prospects remain promising, holding onto your investments might be the wiser choice.

For example, Apple is a prime example of the benefits of patience in the market. In 2008, Apple’s stock price dropped by over 50% amid the financial crisis. However, those who held onto their shares were rewarded handsomely. Over the next ten years, the stock price increased by over 1,000%, generating significant wealth for long-term investors.

While holding on to your investments during crashes can be challenging, it’s important to avoid emotional decisions. Research and understand the fundamentals of the companies you invest in, and develop a long-term investment strategy. If you can weather the short-term storms, the stock market and cryptocurrency market has historically rewarded patient investors with substantial returns.

Financial Freedom Resolution 4) Increase Your Skills, Knowledge & Income

Most of us have a full-time job which finances our monthly living expenses.

But don’t just be complacent and think relying on your current full time job income alone is sufficient for your retirement plan. You want to see your income increase over time, while also learning how to put your money to work by investing them in appreciating assets that grow in value (see Resolution #2 above).

In order to have your salary grow over time as a salaried employee, you will need to keep up with the competitive demands of the job market. Keep on enhancing your skills, read more to broaden your knowledge and perspectives and improve your soft skills such as communication and presentation skills. These can help you to execute your job well, deliver results, stand out in your workplace and potentially increase your salary.

Whether through acquiring new certifications, enrolling in educational programs, or attending workshops, the pursuit of knowledge expands one’s expertise and cultivates a growth mindset. This proactive approach not only helps you to be a rockstar in your current job but also about unlocking doors to exciting new opportunities.

For example, you can read about books and guides that teach you about finance and business, which you can find some recommended ones here.

With greater skills and capabilities, you have greater negotiating power that you can leverage on when asking your employer for a raise – which should be tantamount with the quality of your work.

You can even switch career paths. Some people have made the switch from a lower income industry to a higher income industry (such as finance and technology) just because they learnt the skills and knowledge necessary to make them a valuable hire.

So prioritise continuous learning and skill development and commit yourself to personal and professional growth so that you can thrive in an ever-evolving job market!

Ultimately, investing in skills and knowledge becomes a catalyst for increasing your income and achieving financial success. With the higher income you earn, you can allocate a greater amount towards investments that will compound over time and build that huge retirement nest you dream about.

Financial Freedom Resolution 5) Write Down Your Goals & Take Action

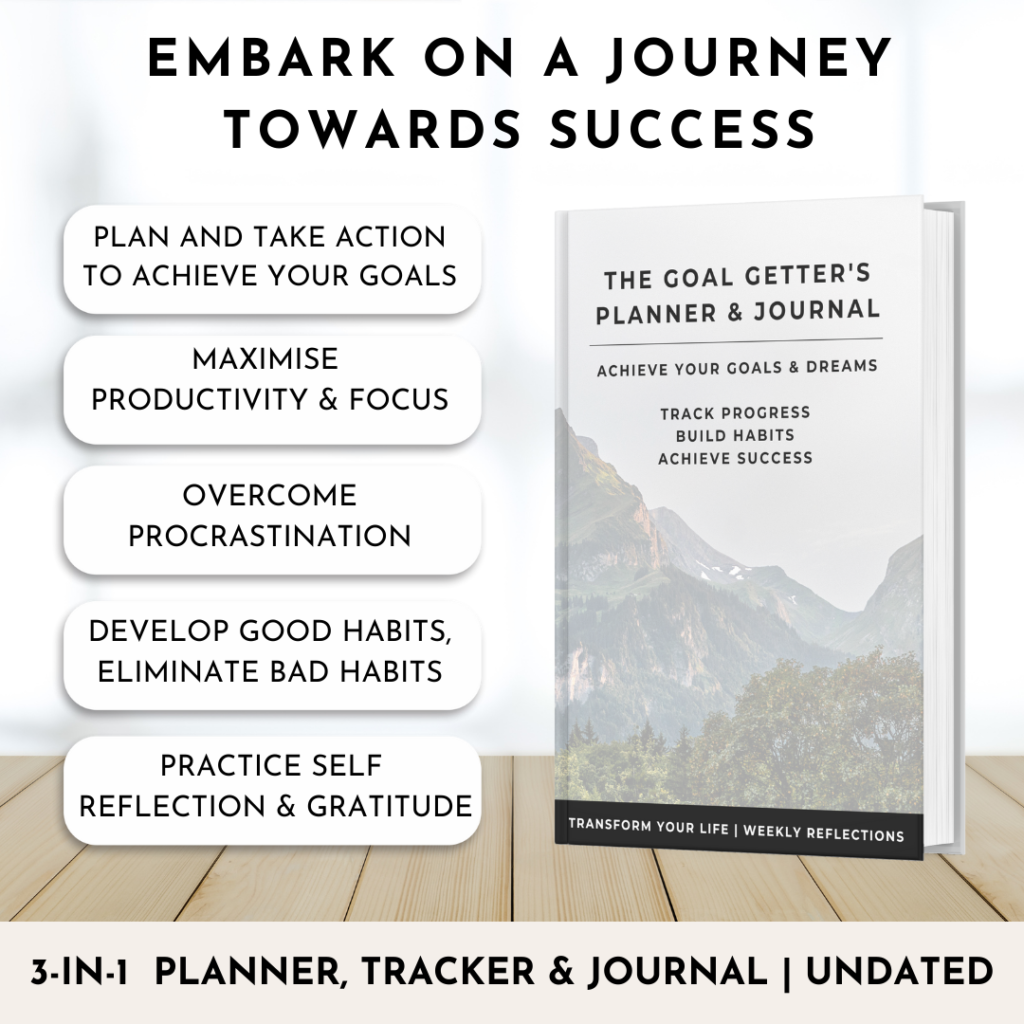

Journaling is not just a therapeutic practice; it can be a secret weapon in achieving your resolutions. Putting pen to paper about your goals, challenges, and progress provides a tangible record of your journey.

First off, it helps crystalize your goals – writing down what you want to achieve is like setting a roadmap to achieve your goals and transform it into reality. It is a step of manifestation, which can empower you to believe in your ability to execute.

When you encounter hurdles, jotting down your thoughts can be a stress-reliever and help you brainstorm solutions. By tracking your progress and highlighting the milestones you achieve over time, you can see the progress which builds up over time, while noting down any room for improvement.

Celebrating wins in your journal can also add positive reinforcement to your journey, making the path to hitting those resolutions all the more rewarding.

So, grab a journal or planner, unleash your thoughts, and watch your goals come to life! 📓💰

To get a journal to write down your 2024 resolutions and map out your plans to achieve your goals, check out The Goal Getter’s Journal!

✅ Priorities Assessment Wheel

✅ Guided space to outline your goals across different areas

✅ Guided space to design your vision board

✅ Interactive Goal Setting Exercises based on the SMART approach

✅ 100-days challenge tracker sheets for shorter term goals

✅ Weekly Accountability Planner – Plan your schedule on a daily basis throughout the week

✅ Weekly Action Priority Matrix – Define your main objectives for the week by categorising tasks according to urgency vs importance

✅ Weekly Habits Tracker – Track your daily habits to cultivate positive habits and eliminate bad habits

✅ Weekly Reflections & Gratitude Journal – Highlight your wins, outline challenges and room for improvement, review habits, note down lessons learnt, and practice gratitude.

Want to learn more about money and growth?

Then subscribe to the newsletter below to get updated on the latest posts and read exclusive subscriber insights!

– Useful Links –

✅ Sign up to TheFinancialFuse newsletter for Market News, Finance Insights & Investment Analysis:

Join TheFinancialFuse newsletter community

✅ Retire Early with My Rich Future’s Financial Budgeting Toolkit

Your Retirement Planning, Budgeting & Portfolio Management Toolkit

✅ Become a Professional Investor – Stock Investment Mastery Course:

Learn to Invest like a Professional Analyst | Fundamental Analysis, Charting Analysis & Portfolio Strategies

✅ How to Get Rich with Megatrends ebook (list of 30+ stocks):

Build a Winning Investment Portfolio with Trending Stocks of the Decade

✅ Open a Brokerage Account – Invest in Global Stocks, ETFs, Unit Trusts & more:

Open your FSMOne USD Savings & Investment Account

✅ Become a Crypto Investor & Trader – Cryptocurrency Mastery Course:

Learn to Make Money with Crypto | Blockchain Analysis, Charting Analysis & Portfolio Strategies

✅ Master Trading with The Trader’s Guide Ebook

Learn to be a Better Trader with Price Action Strategies

✅ Discover the Best Stock Ideas from Professional Analysts (20% off annual membership!):

Join Seeking Alpha premium investing club