What is Personal Finance?

Personal finance refers to the fundamental concept of managing your own finances, covering areas such as budgeting, saving money, and retirement planning.

This comprehensive guide aims to demystify these concepts and provide you with practical insights to empower your financial journey. Let’s embark on this financial adventure together, armed with knowledge that can transform your financial future

a) Budgeting: Building the Foundation for Financial Success

Budgeting is the cornerstone of financial well-being.

Think of your budget as a roadmap for your money – a tool that helps you allocate your funds wisely.

Begin by categorising your expenses into fixed and variable.

i) Fixed expenses are constant and predictable

ii) Variable expenses are occasional expense items, with amounts that may vary across time or just be one-off.

You can also categorise your expenses into needs and wants.

The Envelope System:

Imagine your budget as a set of envelopes, each containing a specific category of expense – groceries, utilities, rental or own home mortgage, transport, entertainment, and so on.

To start off, each month, you should budget for different expense categories each month, prioritising certain categories such as the needs, while being more flexible for categories such as your wants.

50-30-20 rule:

There is a popular rule in personal finance

6-months Emergency Funds rule:

Aside from your expenses and savings for longer-term goals, you should also save for an Emergency Fund, which acts as a safety net during unexpected financial downturns.

The rule of thumb is to have at least 6 months of your monthly living expenses in your Emergency Fund, to help you cover any unexpected situations that may impact your ability to work for a living.

b) Understanding Assets & Liabilities

Assets:

Assets are resources with economic value that an individual or corporation owns or controls with the expectation that it will provide a future benefit.

Examples include house, car, business equipment if any, stocks, bonds, cryptocurrencies, investments in alternative assets etc.

Liabilities:

Liabilities refer to things that you owe or have borrowed (ie. debts that you need to pay off).

Examples include house loan, car loan, personal loan, credit card loan, education loan etc.

Net worth:

Net Worth is also known as equity, and is calculated by this formula:

Net Worth = Total Assets – Total Liabilities.

A positive net worth indicates financial success, while a negative net worth signals the need for adjustments in your financial health. You should assess your net worth every quarter or every year to ensure that you stay afloat (aka have positive net worth).

c) Saving & Investing to Build Your Wealth

Investing is a key to making money while you are sleeping!

Compound interest is the eighth wonder of the world; he who understands it, earns it, he who doesn’t pays it.

The Power of Compound Interest:

Saving money is not just about putting funds aside; it’s about harnessing the power of compound interest.

Compound interest magnifies the impact of your savings over time. The longer your funds remain invested and is able to grow, the more money you will accumulate over time.

With compound interest, not only are you earning interest on your initial capital, but also on the previous interest amounts that you accrue over time.

For example, let’s say you invested $10K in an asset that generates 10% returns per annum.

After 1 year: Your wealth = $10K x (1+10%) = $10K + $100 = $10.1K

After 2 years: Your wealth = [$10K x (1+10%)] x (1+10%) = $10.1K x (1+10%) = $12.1K

After 3 years: Your wealth = [$10K x (1+10%) x (1+10%)] x (1+10%) = $11.1K x (1+10%) = $13.3K

In year 2, you are not just earning 10% interest based on your original capital of $10K, but you are also earning interest based on the 1st year interest amount of $100.

In year 3, you are not just earning 10% interest on your original capital of $10K, but you are also earning interest based on the 1st year interest amount as well as on the 2nd year interest amount, and so on.

By the end of year 3, your capital grew from $10K to $13.3K (a gain of $3.3K which is 33%).

If we only calculate using the concept of simple interest aka 10% returns every year only on the original capital invested, your gains would be $3K which is 30% (3% less than the example with compound interest). The beauty of financial markets is that we can earn compound interest which allows our wealth to accumulate faster, as long as we stay invested.

As such, if you continue to invest over the long term, your capital will keep growing larger as you continue to earn interest on the previous interest amounts that you accrue throughout the years. This is why investing for the longer term can help to magnify your wealth.

Automate Your Savings for Financial Discipline:

You can set up automatic transfers to your savings accounts or other investment accounts to allow your money to play its part in the background, earning compound interest for you without your constant attention. This ensures a disciplined and consistent financial performance.

Investing to Grow Your Wealth:

Investing allows you to grow your money through the financial markets.

Whether it’s real estate, stocks, bonds, cryptocurrencies or alternative investments, each investment forms a part of your overall portfolio.

Each asset differs in terms of its returns and risk profile – generally the principle holds that the higher the potential returns, the higher the risks.

So always remember to never put all your eggs in one basket – this is the principle of diversification.

It is important to diversify your investments across different financial markets in order to manage your risks while maximizing returns.

For example, let’s say you invest 50% of your money in stocks and another 50% in cryptocurrencies.

In case the crypto market collapses while the stock market is not affected, then you can still be financially sound.

In case the crypto market experiences a rally while the stock market is going down, then your gains in crypto can still help to cover for your losses in the stock market, as the gains for crypto in a bull market can range up to 4-digit %s within 1-2 years.

This is much better than investing all of your money in just a single market – as you never know if and when a particular market may collapse.

To learn more about investing in different financial markets, check out the other pages in this website.

d) Retirement Planning

What is your plan for retirement?

By what age can you retire fully?

Typically the retirement age is around 55 or 60. By that age, do you think you would have enough to retire?

What if you plan to retire by reaching financial independence earlier?

How much money do you think you will need in order to live the lifestyle you want throughout retirement or semi-retirement?

How much do you need to retire?

The amount of money that you need upon retirement depends on:

i) Your annual living expenses:

If your monthly living expense is RM3,000, your annual living expense is RM3,000 X 12 = RM36,000.

ii) How long do you expect to live beyond your retirement age:

If you expect to live for 20 years beyond 55, you need to budget for RM36,000 X 20 = RM720,000 based on the example of RM3,000 in monthly living expense. This has not yet account for the effect of inflation, which will increase your living expenses further.

iii) Inflation:

Inflation rate averages around 3-4% per annum, this means that as each year goes by, the cost of living and thus your annual living expenses will increase by 3-4% per annum.

What are your sources of income during retirement?

Is it just depending entirely on your employee/employer contribution fund, which in Malaysia is the Employee Provident Fund (EPF)?

Do you have sufficient funds inside by the time you reach age 55?

You should also have a separate investment fund that you contribute to in order to achieve a comfortable and sustainable retirement life! To do so, start learning how to budget and plan your finances wisely, how to invest in different financial assets, and how to manage your investment portfolio, in order to reach your financial goals!

There are many other useful content on this website and on my Youtube channel where you can learn more about investing & trading so check them out!

If you are interested to start your journey towards financial independence,

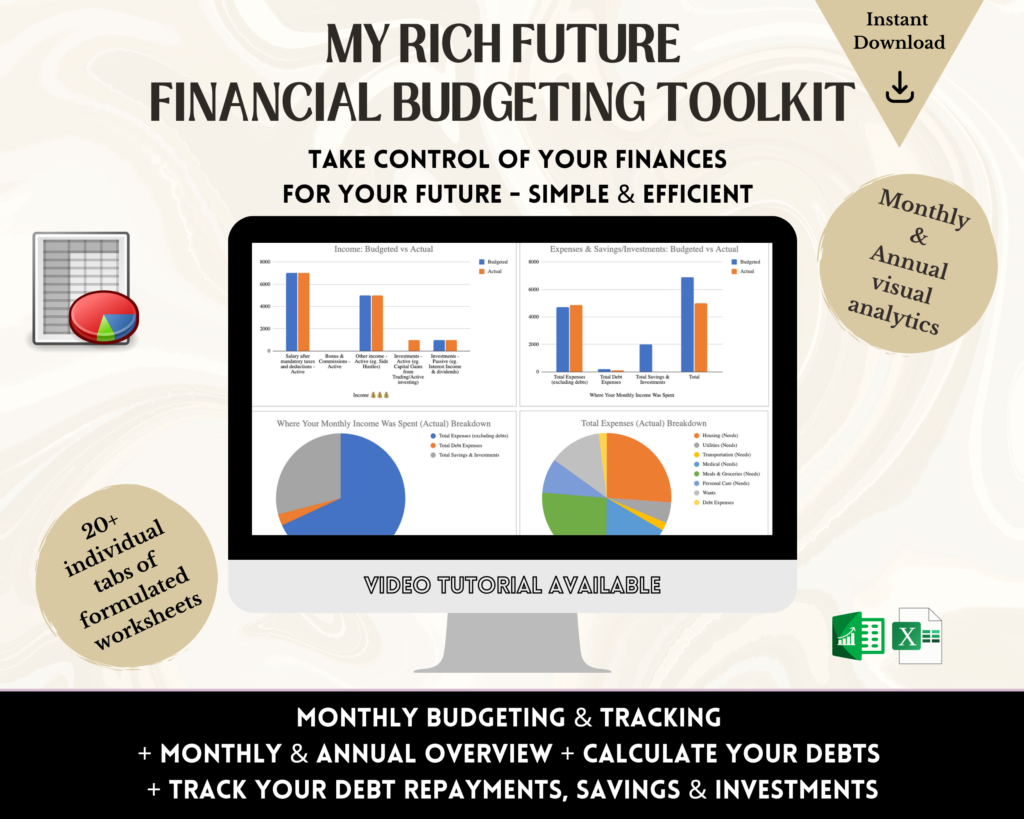

check out My Rich Future: Budgeting & Financial Planning Toolkit

(click on image below)

If you require any 1-1 consultation for your personal finances & retirement planning,

you can send an email to: [email protected]

or send a message via: https://bit.ly/contact-TFF