Are Dating Apps a Losing Investment in 2024?

Many people use dating apps to find love online, and are willing to pay for it. Are dating apps stocks a worthy investment? Which dating app stock is better?

Why People Use Dating Apps

Have you used a dating app before?

If you have not because you already found the love of your life, congrats!

If you have not and are still single, why not give it a try and who knows if you will end up finding the person you marry – yes people do end up finding their life partners online! *not me, maybe I need to try more lol*

Today, the largest two players in the dating app market are Match Group and Bumble.

Match Group

Match Group accounts for around 30% of the online dating market across websites and apps such as Match.com, Tinder, Hinge, Okcupid and more.

Tinder was the most popular online dating app when it first launched in 2012 due to its easy-to-use ‘Swipe’ feature which enables users to Swipe right on someone they like or Swipe left on someone they dislike.

Today, Tinder remains as the most popular dating app in the United States and Europe, according to Business of Apps. It was also the most downloaded dating app in 2023, followed by Bumble.

Bumble

Then, in 2014, a new competitor arose in the online dating scene.

Bumble emerged as a feminist-type dating app that tries to differentiate itself by allowing women to make the first move to initiate conversations, while offering the same Swipe feature. It is founded by Whitney Wolfe Herd which was once a co-founder of Tinder. In November 2023, Whitney was replaced by Lidiane Jones (former CEO of Slack) as CEO of Bumble.

Across the past few years, Bumble has been stealing market share away from Tinder as more people shift towards seeking longer-term high-quality relationships instead of having hook-ups and finding flings via Tinder.

Females tend to find the app safer compared to Tinder which carries a more casual vibe. In fact, it was reported that 91% of singles managed to find a spouse or serious relationship via Bumble.

When Bumble went public in 2021 (7 years after its launched), it raised $2.15 billion during its initial public offering and its share price soared 63% on the first day of trading, making its ex-CEO Whitney the world’s youngest self-made billionaire.

Blackstone (one of the world’s largest investment groups) initial investment of $2 billion in the company earned an extra $2.3 billion upon the sale of its shares, while still holding on to a large ownership stake post-IPO.

The Business Model of Dating Apps: Bumble vs Tinder

Both Match and Bumble operate on a freemium model whereby users can sign up and use the app for free, but additional value-added services come at a monthly subscription payment.

According to Business of Apps, over 300 million people use dating apps worldwide, with about 20 million paying for premium features. A recent report by Pew Research also found that some 35% of Americans who have used a dating website or app have paid.

So how much does it cost to speed up the journey to find the love of your life online?

For Bumble Boost, a weekly plan from $8.99 (or 1 month for $16.99) allows you to unlock unlimited swipes and get your profile a weekly boost to increase your exposure to potential partners.

For Bumble Premium, a weekly plan from $19.99 (or 1 month for $39.99 – among the most expensive monthly plans in the market) allows you to unlock unlimited swipes, get your profile a weekly boost to increase your exposure to potential partners, use Travel Mode to swipe anywhere in the world, see who has already liked you, and rematch with expired matches.

For Tinder, it offers monthly plans which include Tinder Plus ($7.99/month), Tinder Gold ($24.99/month) and Tinder Platinum ($29.99/month).

It launched a super-premium tier in December 2023 called Tinder Select membership, costing $499 per month and only made available for approved candidates that pass through a screening process.

User Growth & Revenue Growth of Dating Apps

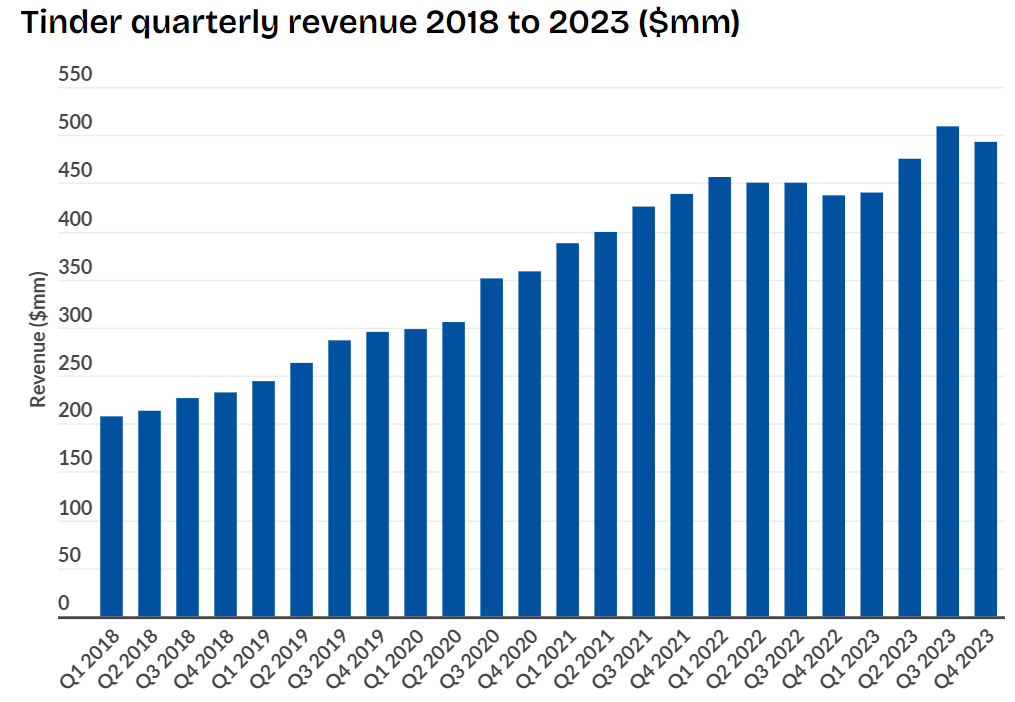

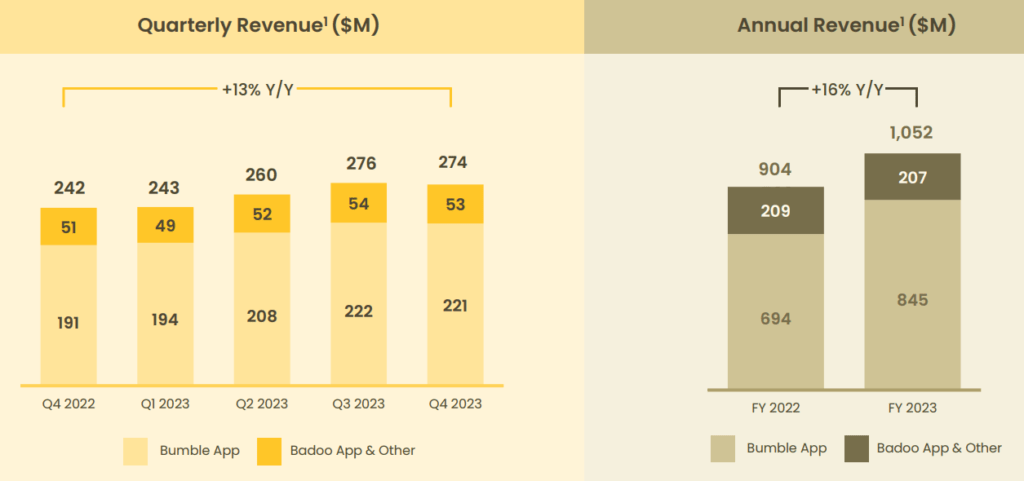

Dating apps have been hot during the pandemic as people increasingly seek relationships and companionship online. Quarterly revenues continue to grow for both companies as shown below.

Tinder’s Revenue Growth:

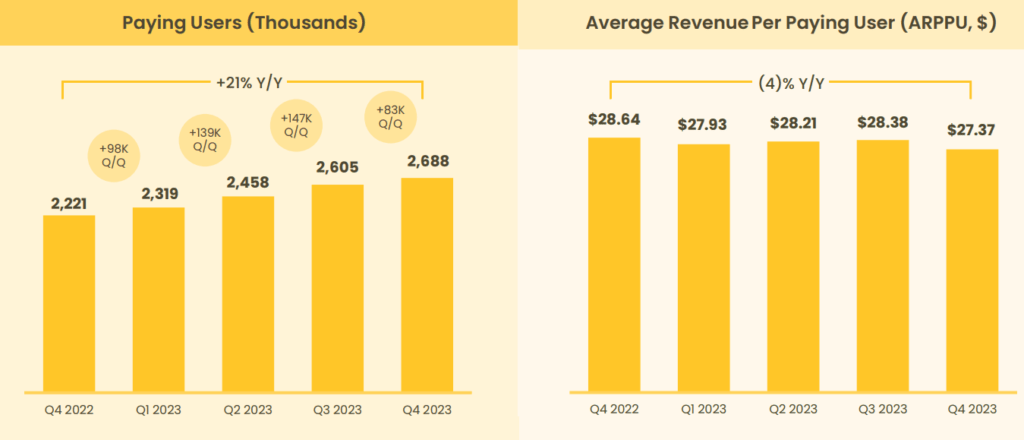

Bumble’s Revenue Growth:

However, both overall and paid user growth has decreased dramatically across all dating apps following those peaks.

Match has been experiencing declining growth in terms of the number of paying users, average revenue per paid user and total revenues.

This is attributed to negative macroeconomic factors such as an upsurge in inflation post-pandemic, causing a decrease in consumer spending overall which also impacted their willingness to pay to get dates. Unfavourable currency headwinds leading to a higher USD also impacted spending by consumers in non-US countries.

Bumble is affected on a negative note similarly. However, compared to Match, it is able to grow the number of paying users and total revenues at faster rates than its competitor.

As user growth slows for both platforms mostly due to external factors, Match and Bumble have shifted more focus on increasing monetization through price increases of their offerings instead of prioritizing user growth, in order to boost the average revenue per paid user to increase total revenues.

Both platforms are also working on improving the quality of user experience and increase user retention.

In February 2024, Bumble announced the launch of a new AI-powered tool called Deception Detector designed to weed out spam, scam, and fake profiles, in order to improve user experience on their application.

Tinder also announced that it is working on several features that prioritizes the quality of women experience on the app, with features focusing on real and relevant experiences through increased trust and safety alongside an improved curation of recommendations. AI features may also be introduced which assist users in selecting the best profile pictures as well as write user profile bios.

Tinder’s FY2023 Overall Performance:

- Total Paying Users decreased 5.6% to 15.2 million in FY2023, compared to 16.1 million in FY2022.

- Total Average Revenue per Paying User increased to $18.67 in FY2023 from $16 in FY2022.

- Net income increased to $651.5 million (19.4% of revenue) from $361.9 million in FY2022 (11.0% of revenue).

- Free Cash Flow for FY2023 stands at $829 million, which allowed it to continue undertaking stock repurchases that reward shareholders. On 30 January 30 2024, the Board of Directors also approved a new share repurchase program up to $1.0 billion in aggregate value of shares of the Group’s stock and stated that it is committed to return at least half of the company’s free cash flow in 2024, signaling that the company has healthy cash flows and maintains its mandate to return capital to reward its shareholders.

Source: Company’s Earnings Letter Q4 2023

Bumble’s FY2023 Overall Performance:

- Total Paying Users increased 16.9% to 3.7 million in FY2023, compared to 3.2 million in FY2022.

- Total Average Revenue per Paying User remains at $23.03 across both FY2023 and FY2022.

- Net loss was $1.9 million (-0.2% of revenue), a decrease compared to net loss of $114.1 million in FY2022 (-12.6% of revenue).

- Although it generated a net loss, free cash flow for FY2023 is still positive at $167.2 million (given that $104.3 million is attributed to stock-based compensation expense which is non-cash expense that is added back).

Source: Company presentation Q4 2023

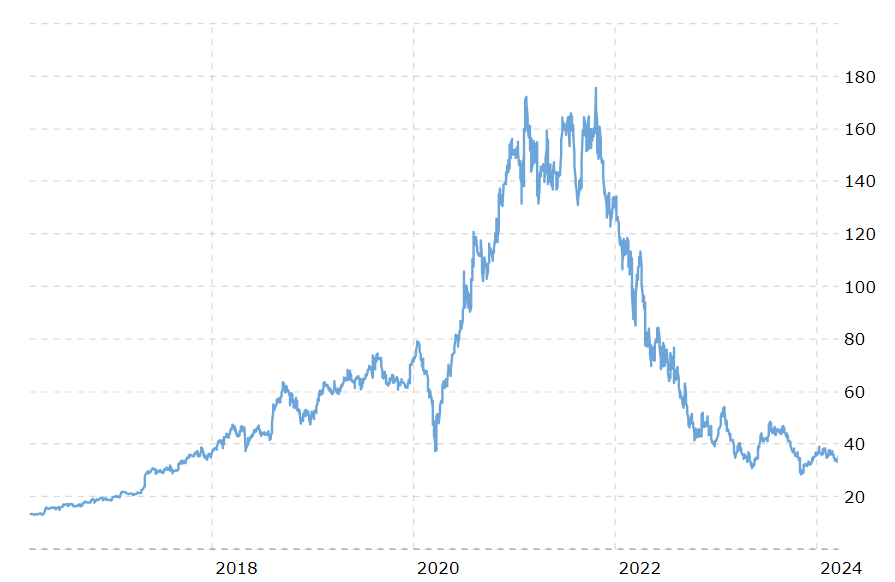

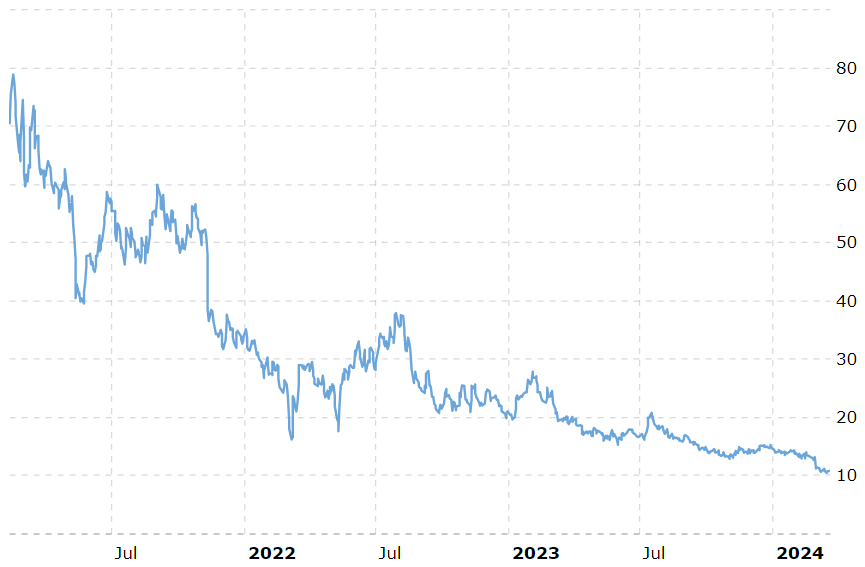

Share Price Performance of Dating Apps

Due to declining user growth and financial performance, both Match and Bumble saw significant declines from their all-time highs since 2021.

Match Group (NASDAQ: MATCH) stock price was trading at $34.80 on 20th March 2024 – representing a decrease of 80% from its highest level of $175.53 in October 21, 2021.

Bumble (NASDAQ: BMBL) stock price was trading at $11 on 20th March 2024, representing a decrease of 86% from its highest level of $78.79 on 16 February 2021 not long after its IPO.

In late February 2024, it announced a roughly 30% workforce reduction laying off roughly 350 employees, citing the negative impact of macroeconomic issues and “company-specific execution challenges”.

The release of its Q4 2023 results showed an unexpected loss of US$0.03 per share on revenues of US$1.1 billion despite an increase in paid users, further leading to a decrease in confidence in the company. This caused its stock price to plunge by 13% to US$11.45 in the week following the release of its results.

Source: Company share price data

Valuation of Dating App Companies

As seen in the share price performances for both dating platforms, both Match and Bumble have been suffering significantly since their all-time-highs in 2021.

Match Group’s valuation:

Price/Sales = 2.67x

Price/EPS = 15.93x

Bumble’s valuation:

Price/Sales = 1.41x

Price/EPS = N/A (loss-making)

Looking forward, analysts expect Bumble’s revenue growth to continue slowing down, with the forecast 9.4% annualised growth rate until the end of 2024 being well below the historical 19% p.a. growth over the last five years.

Investment Considerations

Comparing both Bumble and Match Group, here are some key highlights:

In terms of revenue growth, Bumble has been consistently growing faster than Match Group, in which it increased revenue by at least 18% across each of the past 4 years. Match Group is still growing, but growth has slowed to a single-digit across the recent year.

In terms of user activity, Bumble has been increasing its number of paying users over time, while Match Group experiences a decrease. Average Revenue per Paying User is higher for Bumble than Match, likely due to Bumble’s monthly plan being more expensive, as well as the growth in the base of paying users.

In terms of profitability, Match Group is profitable while Bumble is still making losses. Match Group also has considerable cash in its pockets with strong cash flow generation and minimal capital expenditure, enabling it to reward shareholders with share repurchases year after year.

Bumble has more room to catch up in terms of profitability and cash flow. Nonetheless, its losses have been declining considerably, and when it starts generating profits the company may spark further investor attention.

Management’s operational execution will be key in determining the path to profitability for the company moving forward.

In terms of valuation, Match Group has a lower price-to-sales ratio than Bumble, which means it appears to be slightly cheaper.

Summary

So which stock is better?

Match Group’s stock may be safer given it’s cheaper, the company is profitable and it has a huge $1.0 billion share repurchase program in place.

However, Bumble has been growing consistently faster in terms of revenues and number of users, along with a higher average revenue per paying user. If the higher growth can be accompanied by positive profits, it will become more attractive.

We will have to monitor how well both Match Group & Bumble execute their growth plans as well as drive more users to become paying users, all while keeping expenses in check to ensure profitability moving forward.

Which dating app do you prefer as a user?

Which stock would you prefer based on the above?

Do you think online dating apps can still grow further post-pandemic?

Let me know in the comments section below!

– Useful Links –

✅ Sign up to TheFinancialFuse newsletter for Market News, Finance Insights & Investment Analysis:

Join TheFinancialFuse newsletter community

✅ Retire Early with My Rich Future’s Financial Budgeting Toolkit

Your Retirement Planning, Budgeting & Portfolio Management Toolkit

✅ Become a Professional Investor – Stock Investment Mastery Course:

Learn to Invest like a Professional Analyst | Fundamental Analysis, Charting Analysis & Portfolio Strategies

✅ How to Get Rich with Megatrends ebook (list of 30+ stocks):

Build a Winning Investment Portfolio with Trending Stocks of the Decade

✅ Open a Brokerage Account – Invest in Global Stocks, ETFs, Unit Trusts & more:

Open your FSMOne USD Savings & Investment Account

✅ Become a Crypto Investor & Trader – Cryptocurrency Mastery Course:

Learn to Make Money with Crypto | Blockchain Analysis, Charting Analysis & Portfolio Strategies

✅ Master Trading with The Trader’s Guide Ebook

Learn to be a Better Trader with Price Action Strategies

✅ Discover the Best Stock Ideas from Professional Analysts (20% off annual membership!):

Join Seeking Alpha premium investing club