Want to achieve a comfortable retirement in Malaysia?

A crucial step is to start saving and then invest your money in financial assets that will grow in value over time.

Most Malaysians invest in the Employee Provident Fund (EPF) which is compulsory for salaried employees, but there is also an additional option known as Private Retirement Scheme (PRS).

In this article, I will be sharing about the similarities & differences of EPF and PRS, and how you can invest in PRS to achieve early retirement!

Why save and invest money for retirement?

According to EPF Malaysia, Malaysians need to have at least RM240,000 to meet the Basic Savings Threshold. However this is just a small amount, which may not be enough for most people, depending on one’s lifestyle.

For example, if your monthly living expenses is RM2,400, you will use up RM240,000 by the end of 100 months (about 9 years). If you live longer than 9 years beyond your retirement age, you will have no money left 🙁

The amount of money you need to have for retirement depends on various factors, including:

i) Your lifestyle – your expected amount of monthly living expenses

ii) Your estimated lifespan – How long you expect to live beyond your retirement age

iii) Inflation rate in the country you live in

Lifestyle

If your monthly living expenses are high because you practice or intend to have a comfortable lifestyle, you need more money to finance your retirement.

Lifespan

If you expect to live for a considerable number of years beyond your retirement age, then you need more money to finance your retirement.

Inflation

Inflation reduces the your purchasing power. In most countries, inflation is the norm where prices for the same goods and services are increasing every year. As such, your RM100 today is worth less next year, because for the same amount of money you can only afford to purchase a smaller amount of the same goods and services compared to this year.

In Malaysia, the average annual inflation rate is around 3%-4%, which means your money loses value by 3%-4% every year.

In order to keep up with or beat inflation, your investments will need to grow by more than the inflation rate, so that you will not lose purchasing power and compromise the quality of your life!

How to Invest Money for Your Retirement

Have you started saving money for your retirement yet? You may still be young, but time Is the best tool to generate you wealth in the stock market!

For example, assuming that you invest RM1,000 every month and your money compounds at an annual rate of return of 6%.

These will be the results of your investment:

i) After 10 years, you will have RM158,169.

ii) After 30 years, you will have RM948,698.

If you are able to save and invest RM1,000 every month and your money compounds at an annual rate of return of 10%, then this would be the wealth you built over the years:

I) After 10 years, you will have RM191,249 (RM33K extra compared to the case in which you earn 6% annually).

ii) After 30 years, you will have RM1,973,928 (RM1.0 million extra compared to the case in which you earn 6% annually).

From the above, we can see that you will have more money in the following cases:

a) The longer your period of investment, the greater the amount of wealth you can accumulate

b) The higher the rate of return on your investments, the greater the amount of wealth you can accumulate

Investing with EPF for Retirement in Malaysia

What is the Employee Provident Fund (EPF) in Malaysia

- It is mandatory for Malaysian salaried workers to contribute to EPF for their future retirement.

Monthly contributions are made up of the employee’s and employer’s share. The employee’s share currently stands at 13% of monthly gross income.

For voluntary contribution by non-salaried workers (eg. freelance workers, ride-sharing drivers), the maximum limit of voluntary contributions under the i-Saraan scheme is only RM100,000 per year.

Members under 55 will get 3 accounts:

i) Akaun Persaraan (previously known as Account 1) – can only access after 55 years old

ii) Akaun Sejahtera (previously known as Account 2) – can be accessed for partial withdrawal

iii) Akaun Fleksibel – flexible savings account that can be accessed for withdrawal anytime (minimum withdrawal amount of RM50)

Prior to May 2024, for members aged below 55, 70% of EPF contributions go into Account 1, while 30% goes into Account 2.

From May 2024 onwards, EPF contributions would be split in three ways:

i) 75% goes into Account 1,

ii) 15% goes into Account 2, and

iii) 10% goes into Account 3.

You can only withdraw your EPF funds entirely at the age of 55.

When you reach 55, you will have 2 EPF accounts:

i) Akaun 55 is a combination of Account 1, Account 2 and Account 3. It can be withdrawn once a member reaches 55 years old.

ii) Akaun Emas is an account that exist after a member reached 55 years old. Any contribution after the age 55 will be credited into this account and can only be withdrawn once the member reaches 60 years old.

Prior to reaching the age of 55, you can apply for partial withdrawals for Account 2 (only for selected reasons as highlighted on EPF website).

If you require money for any needs at any age, you can withdraw entirely from your Account 3 (subject to a minimum amount of RM50).

Returns of Investment with EPF

As stated under Section 27 of the EPF Act 1991, the guaranteed minimum dividend rate for EPF members is 2.5% annually. This means that even if the EPF has a bad year of investment performance and register annual losses, EPF members will still receive 2.5% returns on their savings amount (the minimum).

Historically, EPF has registered average rates of return between 5% to 6% per annum.

Additionally, your EPF contribution is entitled to a tax relief of up to RM6,000 per year, which in a way can also considered to be an income or part of your returns.

What is the Private Retirement Scheme (PRS) in Malaysia?

What is the Private Retirement Scheme (PRS)?

Private Retirement Schemes (PRS) is a voluntary contribution scheme to enable Malaysians to increase their retirement amount beyond their EPF savings. It was launched in Malaysia in 2012.

In contrary to EPF which is mandatory and where the funds are managed by government bodies KWSP, PRS is a voluntary long-term investment scheme, offered by only a few private asset managers regulated by the Securities Commission Malaysia.

What are the benefits of PRS?

i) Increase Your Retirement Savings

PRS is a way for Malaysians to increase their retirement savings (beyond EPF contribution amount) and diversify from EPF.

As it is a voluntary scheme, you can contribute flexible amounts – as little as RM50 or a fixed percentage of your monthly income to the scheme, depending on your retirement goal.

This is a good option for non-salaried workers which may not have a fixed monthly income, and which may want to contribute more than RM100,000 per year into their retirement fund (beyond the EPF annual limit).

ii) Diversification

In investment, the concept of diversification can make a huge difference in your wealth. Diversification means spreading your investments across different assets, funds or schemes.

Let’s say there are some years that EPF didn’t perform that well and only generate the minimum guaranteed return of 2.5%, but the PRS fund that you invest in was able to beat EPF returns by a considerable margin. So overall, your retirement fund performance can still be higher even if the EPF generates sub-par returns.

There are various types of funds that you can choose from within the PRS space, some which have the potential to generate higher returns depending on the investment style.

iii) Additional Income Tax Benefits

By investing in PRS, you get to enjoy Individual Tax Relief up to RM3,000 per assessment year, which is in addition to the tax relief associated with your EPF contribution.

This tax relief has been extended until the 2025 tax assessment year until further notice.

iv) Flexibility in Choosing Funds

With EPF you can only invest in a single fund, which is the same for all EPF members.

With PRS, there are multiple funds to choose from, which gives you choice and also flexibility.

You can choose to invest in aggressive, moderate or conservative funds based on your own risk profile and preferences.

Aggressive growth funds can give you higher returns, while conservative funds exhibit lower returns but are less risky and thus suitable for those who are nearing retirement age or those who cannot stand looking at large changes in their portfolio performance.

What can you invest in with PRS?

There are only a few investment companies regulated by the Securities Commission Malaysia that offer PRS funds, and the schemes are safeguarded by the Scheme Trustees.

In this article, I am going to review Versa’s PRS funds, which are managed by Affin Hwang Asset Management (AHAM).

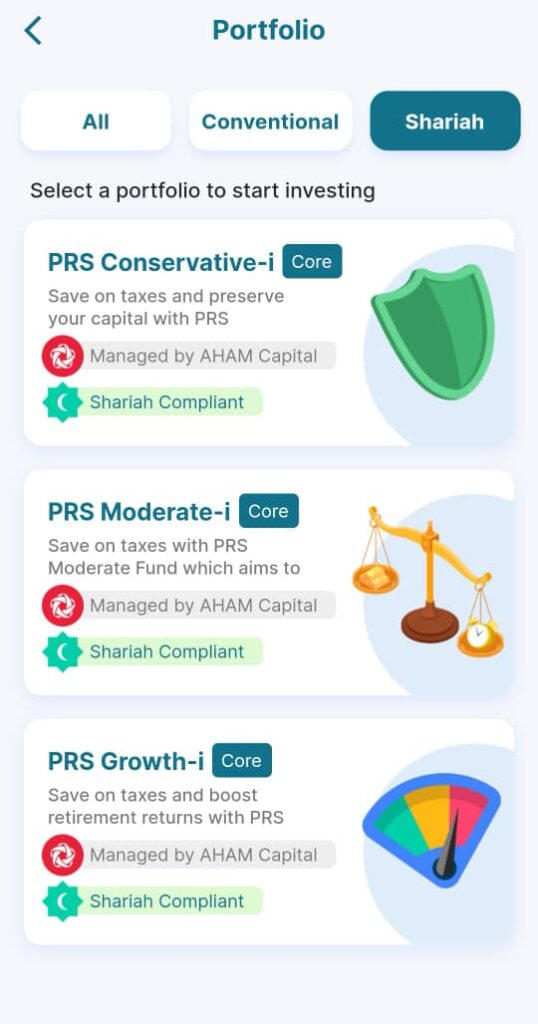

There are 6 funds that you can choose from, whether Conventional funds or Shariah funds.

List of Versa PRS funds:

- AHAM PRS Conservative Fund

- AHAM PRS Moderate Fund

- AHAM PRS Growth Fund

- AHAM Aiiman PRS Shariah Conservative Fund

- AHAM Aiiman PRS Shariah Moderate Fund

- AHAM Aiiman PRS Shariah Growth Fund

You can choose the type of fund you are interested in – depending on your age and risk appetite.

How to choose which PRS funds to invest in?

If you are younger and able to take risks, then you can choose the growth fund which invest in higher risk but also higher return assets like growth stocks.

This gives you the opportunity to earn potentially higher returns than your EPF investment.

With higher returns, your wealth will be able to grow faster.

For example, using the Rule of 72, you can calculate how fast it takes for your money to double in amount.

Eg. 4% returns – 72/4 = 18 years

Eg. 6% returns – 72/6 = 12 years

Eg. 8% returns – 72/8 = 9 years

Eg. 10% returns – 72/10 = 7.2 years

From the above, you can see that the higher the annual average return, the shorter the time taken for you to double your investment capital. Thus, if you want to grow your wealth faster, you can consider to allocate more money towards a growth fund.

However, if you are near retirement and cannot afford to take extra risk, it may be more prudent to go for a conservative fund with lower volatility.

You can also divide your savings across different PRS funds to balance out your risks and returns. For example, invest 50% of your savings in growth funds, and the remaining 50% in moderate funds.

How to Start Investing in PRS funds via Versa

If you would like to invest in Versa (regulated by Securities Commission Malaysia), sign up for an account on your mobile phone using this link.

By registering using my referral link above or by manually inputting my referral code CLHKSP9L in the app’s registration page, you get to enjoy:

✨ Versa PRS Offer ✨

✅ Up toRM50 Versa Cash Bonus

✅ Income tax relief of up to RM3,000 in PRS contributions

* Valid for new users that cash in a minimum total of RM3,000 into any PRS fund in Versa

Start building your retirement fund today so that you can enjoy your life in retirement without relying on anyone else including your kids!

If you want to develop a healthy relationship with your finances and plan for early retirement, you should start budgeting, planning your finances and managing your investments! Check out My Rich Future’s Financial Budgeting Toolkit to help you on your journey towards financial freedom!

– Useful Links –

✅ Sign up to TheFinancialFuse newsletter for Market News, Finance Insights & Investment Analysis:

Join TheFinancialFuse newsletter community

✅ Retire Early with My Rich Future’s Financial Budgeting Toolkit

Your Retirement Planning, Budgeting & Portfolio Management Toolkit

✅ Become a Professional Investor – Stock Investment Mastery Course:

Learn to Invest like a Professional Analyst | Fundamental Analysis, Charting Analysis & Portfolio Strategies

✅ How to Get Rich with Megatrends ebook (list of 30+ stocks):

Build a Winning Investment Portfolio with Trending Stocks of the Decade

✅ Open a Brokerage Account – Invest in Global Stocks, ETFs, Unit Trusts & more:

Open your FSMOne USD Savings & Investment Account

✅ Become a Crypto Investor & Trader – Cryptocurrency Mastery Course:

Learn to Make Money with Crypto | Blockchain Analysis, Charting Analysis & Portfolio Strategies

✅ Master Trading with The Trader’s Guide Ebook

Learn to be a Better Trader with Price Action Strategies

✅ Discover the Best Stock Ideas from Professional Analysts (20% off annual membership!):

Join Seeking Alpha premium investing club