Cathie Wood is a famous American investor that runs ARK Invest, an investment management firm. Her funds are all centred around technology stocks focused on innovation aka growth stocks.

Investing like Cathie Wood

Cathie Wood Investments in Q1 2024 has undergone some changes – with new purchases and sale of some of the hottest tech stocks.

1. Coinbase

Cathie Wood has been a strong supporter of cryptocurrency since several years ago.

Her ARK Invest funds have held Coinbase shares (NASDAQ:COIN) for years in order to gain exposure to cryptocurrencies. Coinbase is currently the largest cryptocurrency exchange in the United States in terms of trading volume.

Following the launch of spot Bitcoin ETFs in the US, investors’ money have been pouring greatly into the crypto space, enabling Bitcoin to hit a new all-time-high above $73,000 during March 2024.

Despite this, Ark Invest has been offloading Coinbase shares throughout Q1 2024. In March alone it registered 2 sale transactions, totalling $148 million worth of Coinbase shares.

Does this mean that Cathie Wood has lost interest in Bitcoin?

In a recent statement, Cathie mentioned that Bitcoin’s price could easily rise above $3.5 million given the increase in institutional interest. This contradicts her firm’s action of selling off Coinbase shares, but affirms that her long term view on Bitcoin is still very optimistic.

Perhaps the selling off of Coinbase shares signalled that Cathie thinks that Bitcoin is overvalued in the short term, but she is still confident in the longer term outlook.

As we observe, the overall crypto market is greedy as shown by the Fear & Greed Index below:

Warren Buffett famously shared that we should sell when everyone else is greedy. Guess Cathie Wood is practicing this too, although their investment styles have widely differed over the years.

2. Tesla

ARK increased its stake in electric vehicle giant Tesla Inc (NASDAQ:TSLA), purchasing 116,408 TSLA shares worth $20,117,631.

This is despite Tesla plunging in price across Q1 2024 as investors lost confidence in the company amid a slowdown in revenue growth.

As of Q1 2024, Tesla holds the spot as the worst-performing stock on the S&P 500, losing more than $240 billion in just 3 months.

New sales of electric vehicles have been slowing down especially in China. With sales volume decreasing to a 12-month low, its CEO Elon Mush has been resorting to cutting prices in order to boost sales, leading to a reduction in profit margins.

Given that Wall Street analysts pay most attention to actual profits vs expectations, the negative company performance has adversely affected Tesla’s share price.

Looking forward for the rest of 2024, Elon Musk (CEO of Tesla) stated new vehicle sales would be “notably lower” than 2023 levels, given uncontrollable macroeconomic factors such as high interest rates and an inflationary environment in US, alongside weak economic growth in China.

However, while other investors panic sold Tesla shares, Cathie’s new purchases signalled that she may think Tesla shares are undervalued at this stage.

3. Meta

ARK also bought 24,917 shares shares of Meta Platforms Inc (NASDAQ:META) worth $12,651,856 in value.

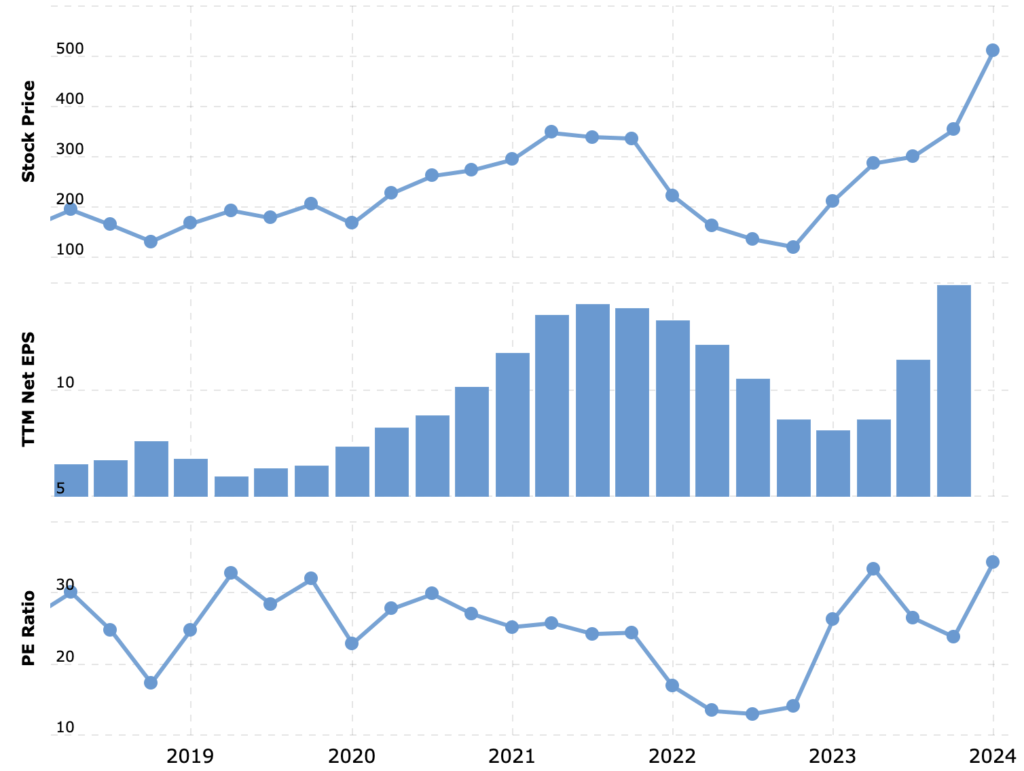

Not too long ago, a slowdown in digital advertising coupled with rising interest rates in the US caused Meta shares to crash by 77% from its previous all-time high in September 2021 to its November 2022 low. At that time, its price-to-earnings ratio fell from around 30x to below 12.6x, presenting an attractive opportunity to pick up a top technology stock that has more than 3 billion active users.

Across 2023, its performance has been gradually improving following an improvement in financial performance due to i) a reduction in operating expenses from mass layoffs, ii) a pick up in digital advertising sales, as well as iii) a market-wide rally in tech stocks amid the AI hype.

Most recently, its latest fourth-quarter 2023 financial results showed Meta recording an annual increase of 16% in revenue across 2023, with sales standing at $134.90 billion. It is also generated free cash flow of $43.01 billion for the full year of 2023.

Meta is a dividend-paying stock that is still growing its annual revenues at double-digits, thus the stock is a good pick. However, it is currently at a new all-time high with P/E ratio also at a 5-year high (at 34x as of 24 March 2023).

Nonetheless, it can be a good longer-term pick should price retrace for an attractive entry opportunity.

If Tiktok gets banned in the US, Meta may also benefit as competition in the social media space reduces.

Source: Macrotrends

4. Pinterest

Guess Cathie Wood likes social media stocks alot.

ARK funds bought over $23 million worth of Pinterest shares recently.

Based on the latest financial results, Pinterest’s revenue grew 9% in 2023 as its Monthly Active Users increased by 11% year-on-year to 498 million.

The company is still making a loss, but growth has been improving.

Partnerships appear to be a core strategy for Pinterest for further expansion – in 2023 it partnered with Amazon for digital advertising (with Amazon being featured in approximately 30% of Pinterest’s search term ads).

In its latest earnings call in Q1 2024, Pinterest announced an ad partnership with Google, which led to a positive stock price reaction.

It does not seem like a sexy stock to me compared to other tech stocks, but improved growth and a shift towards profitability should increase its attractiveness.

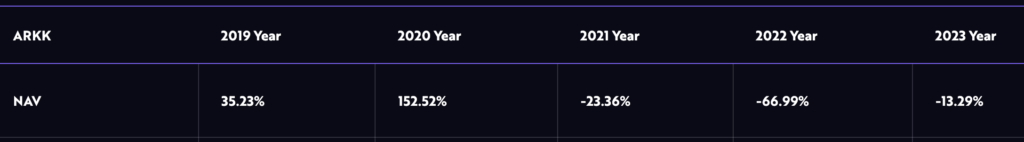

Cathie Wood’s Investment Track Record

Cathie Wood’s ARK ETFs have not been performing that well compared to other hedge funds across the past few years.

This is more profound in 2022 (when the sudden sharp increase in US interest rates led to a crash in technology stocks). In fact, ARK ETFs registered annual losses exceeding 60% in that year.

Could her strategy be right this time around?

It seems like she is employing a contrarian strategy (selling Coinbase shares just after Bitcoin hit a new all-time high) while acquiring more Tesla shares (compared to the majority of investors that have been swiftly selling off Tesla shares in Q1 2024).

What do you think of her actions? Are you buying/selling Bitcoin and Tesla?

Let me know in the comments below!

– Useful Links –

✅ Sign up to TheFinancialFuse newsletter for Market News, Finance Insights & Investment Analysis:

Join TheFinancialFuse newsletter community

✅ Retire Early with My Rich Future’s Financial Budgeting Toolkit

Your Retirement Planning, Budgeting & Portfolio Management Toolkit

✅ Become a Professional Investor – Stock Investment Mastery Course:

Learn to Invest like a Professional Analyst | Fundamental Analysis, Charting Analysis & Portfolio Strategies

✅ How to Get Rich with Megatrends ebook (list of 30+ stocks):

Build a Winning Investment Portfolio with Trending Stocks of the Decade

✅ Open a Brokerage Account – Invest in Global Stocks, ETFs, Unit Trusts & more:

Open your FSMOne USD Savings & Investment Account

✅ Become a Crypto Investor & Trader – Cryptocurrency Mastery Course:

Learn to Make Money with Crypto | Blockchain Analysis, Charting Analysis & Portfolio Strategies

✅ Master Trading with The Trader’s Guide Ebook

Learn to be a Better Trader with Price Action Strategies

✅ Discover the Best Stock Ideas from Professional Analysts (20% off annual membership!):

Join Seeking Alpha premium investing club